News

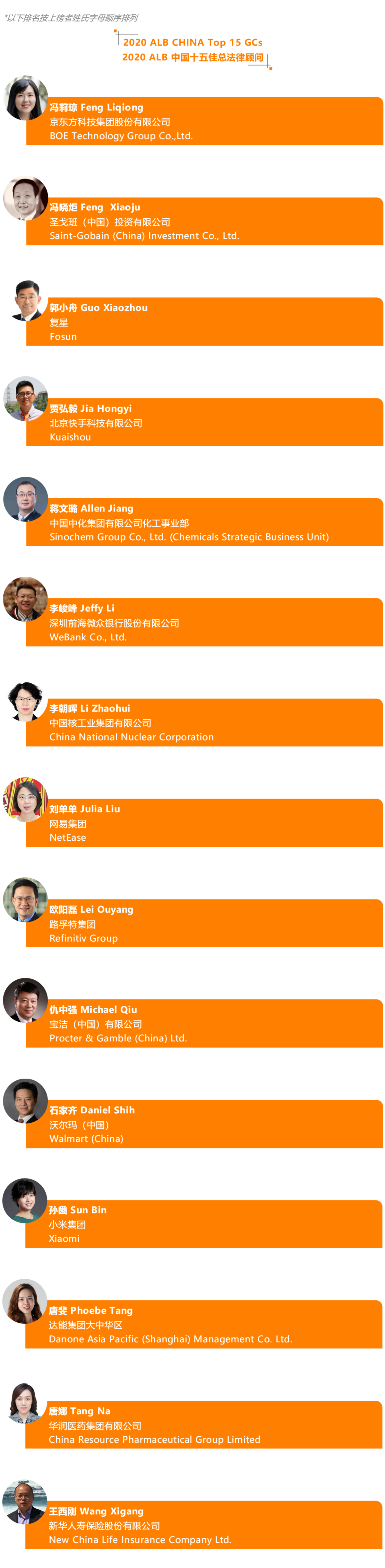

ALB CHINA 2020 Top 15 General Counsel list unveiled

Outstanding general counsel in China today are no longer just "guardians" of enterprises. They actively participate in enterprise management and business decision-making – using their legal expertise and industry knowledge to help enterprises expand business areas, explore emerging markets, and optimize business models, and meanwhile facilitate research and development. And they even have significant impact on, and play an important role in promoting the development of the industry and formulating relevant laws. They not only have become an important part of the business, but also make positive contributions to the society.

The general counsel who made the list this year are from the Internet, food, pharmaceutical, finance and other industries. The rapid development of these industries is driving the accelerated changes in enterprises, and the definition of the role of general counsel is constantly renewed. Feng Liqiong, senior vice president and chief lawyer of BOE Technology Group Co., Ltd., believes that in-house lawyers must change their role from risk manager to operation manager, continue to innovate and develop cross-industry thinking, to create greater value for their companies. She suggests that in-house counsel change their mentalities, and see things from the perspective of business managers, which can help them to better understand the company's strategy, grasp the essence of business, and discover the legal risks at the strategy and business level. Based on that, in-house counsel can design transaction structures and solutions that create the best value for their companies, to realize the "integration of legal services into business solutions."

Providing legal advice to their companies for the business decisions on major projects, helping their companies set up robust compliance systems to identify and avoid risks, and winning favorable rulings for their companies when involved in lawsuits, GCs are doing much more today by serving as their companies' business managers or even leaders. For example, Feng led her team to establish an international compliance system for BOE base on the characteristics of the display industry today, involving elements such as domestic manufacturing, and global buy and sell, which helps BOE effectively respond to compliance risks arising from trade frictions and country-specific import and export controls. Feng has also been actively and deeply involved in the company's senior management, including strategy formulation, management model design and major decision-makings. Feng and her team witnessed and supported the company growing into a large global high-tech company.

Michael Qiu, Global Senior Vice President of Procter & Gamble (China) Ltd., designs and implements a comprehensive and effective anti-bribery and anti-trust compliance system in P&G Greater China region. He also reshaped the vision and strategies of P&G Greater China government relations to focus on the strategic relationship building with central and local key government stakeholders and high profiling corporate reputation building. Qiu guided P&G Greater China business to navigate through the US-China trade war, proactively engaging with both US government and Chinese government to mitigate risks to business. He led to lobby laws and regulations for favorable policies to protect business and gain competitive advantages in China, and strategized to continuously fuel P&G Greater China business by gaining government financial support.

As general counsel of Danone Asia Pacific (Shanghai) Management Co. Ltd., Phoebe Tang assisted Danone to successfully complete its major M&A projects, and helped the company quickly overcome the challenges after acquiring a U.S. diary producer Whitewave, by formulating short-term and medium-term solutions for its products to enter the Chinese market, and thus paving the way for new lines of business to enter China. Furthermore, Tang and her team helped three business units of the company to quickly launch a variety of new products in the Chinese market, which not only solved the business continuity issues, but also effectively enhanced the brand awareness and sales volume.

These outstanding GCs also play an active role in promoting the legislative process and perfecting the legal system. Li Zhaohui is the general counsel of China National Nuclear Corporation. She has participated in the drafting of several legislations as expert team members, and serves as the legal counsel of government regulatory agencies. She has been deeply involved in the drafting and formulation of laws and regulations related to nuclear and energy fields and national defense industries. She also proposes special management requirements of the nuclear industry in a number of comprehensive legislations of the State, making remarkable contributions to China's nuclear legislation work. Moreover, Li accompanied the legislative departments of the NPC and the State Council to conduct in-depth legislative researches in the relevant units of China's nuclear industry, and participated in the revision of the draft Atomic Energy Law and the research work on China's nuclear responsibility system. Meanwhile, Li participated in the drafting, research, formulation and revision of many international conventions as the only legal officer from China. She also participated in the organization of the China-EU and China-U.S. nuclear legal forums and made keynote speeches there.

Lei Ouyang, chief counsel of Refinitiv Group (Mainland China/South Korea/Taiwan), leads Refinitiv's business model optimization project in China, which aims to optimize the existing business models from the legal and commercial perspective, including matters related to contract signing, cloud services, network information security, and data protection. Under his leadership, Refinitiv China's senior management team and overseas business team, through continuous explorations, discussions and negotiations with Chinese regulators, professional intermediaries, local governments and important clients, made significant breakthroughs in some important legal issues related to foreign investments in China, which provide important reference value for legislative progress in the relevant fields.

Meanwhile, Tang spoke for Danone and the entire industry, led her team to participate in the drafting of a number of domestic and foreign laws and regulations, and to provide valuable supports and resources for the government in the legislation related to data collection, overseas legislative data analysis, and market research. Because of their active participation, Danone is recognized as an important industry legislative contributor and a trusted partner, providing relevant Chinese administrative departments with analysis of overseas laws and regulations, and helping the government understand the development of legislation around the world.

While celebrating the contributions of the winners, we spoke to some of them, who shared with us their understanding of general counsel’s role in an enterprise, their successful experiences in addressing industry challenges, and their outlook for the future.

GC: A COMBINATION OF LEGAL AND BUSINESS

Julia Liu, vice president and general counsel of Internet giant Netease, believes that GCs need to grasp the essential business characteristics of the industries, as well as the relevant laws, regulations and policies, and keep abreast of the related changes and updates, to give robust legal supports to their companies while helping the companies to find the best development path. "The goal of a general counsel should be providing driving force to the development of the company, taking business as orientation and law as criterion,” says Liu.

Liu’s opinion is echoed by Guo Xiaozhou, assistant president and general manager of the legal department of Fosun Group. He says: "Fosun has diversified lines of business and has set up its presence in a wide range of regions, requiring our legal team have industry-specific proficiencies as well as strong comprehensive capabilities. Therefore on the one hand, a GC needs to be like a partner of a law firm, knowing the legal technology and having analytical thinking, project execution capabilities and management capabilities; and on the other hand, we should develop business acumen, and internal coordination and decision-making capabilities, so that we can control risks and meanwhile work together with business departments to contribute to the success of Fosun's business strategy and ecological construction."

Tang stresses the GC's role in safeguarding enterprises and promoting the growth of business. "A GC is one of the important decision-makers concerning business needs and a key driver of the success of the enterprise's strategy. Protecting the company's assets and reputation, paving the way for business expansion, removing barriers to market access, and exploring ways to help the company reach deals, these are our main responsibilities," she points out.

MEETING THE CHALLENGES

The speed of industrial changes means dynamic challenges to everyone. The GCs share with us how they have successfully dealt with the issues brought about.

Jeffy Li, general manager of Legal & Compliance Department at WeBank Co., Ltd., says that in recent years, risk prevention has been one of the top regulatory concerns for financial industry, and more comprehensive and detailed laws governing bank development have been promulgated, posing higher and stricter requirements for systematic, dynamic and flexible compliance management. As the global economy is slowing down, clients pose new demands; the extensive and thorough application of technology in finance industry has triggered more legal issues, such as legal issues related to effective protection and rational use of customers' information; and digital-only credit services have presented objective requests for re-formulation of procedures; all of these have brought tough challenges to GCs.

To tackle the challenges, Li believes that first, they need to grasp the essential points of financial regulation and have effective communication with financial regulators, and judge the rationality and compliance of new business forms and new financial products based on the principles of fairness and good faith and by taking into account the interests of customers, to help the company design and offer banking products and services that best meet the market needs. Secondly, amid the extensive and thorough application of technologies in banks, such as cloud computing, blockchain, AI and big data, it is very important for GCs to actively learn about new technologies, and evaluate and analyze the connections between the application of new technologies and legal issues, so that they can develop mechanisms for responding to and solving the dynamic problems. Thirdly, given the fact that clients' needs are more diversified and financial products more complex, GCs need to the help the business department to find and locate the right products that financially and legally fit the customers' needs, especially those of the customers in the "sinking market", and clearly define responsibilities of the company and customers, thus legally protecting the interests of the bank and its customers; And finally, in addition to clarifying the civil and commercial legal relations, and managing and controlling convenience services according to law, it is necessary to explore to find more efficient technology-based dispute resolution mechanisms. Moreover, it is important to intensify training and guidance for financial customers in the "sinking market", to improve the satisfaction of financial consumers.

Liu of NetEase notes that technological innovation and content innovation are driving the rapid development of the Internet industry around the world. To maintain a leading position in such a competitive field, the company's leaders must be dedicated and down-to-earth, focus on products and R&D, and have a great leadership. "I lead my team to find and implement a set of scientific management approaches that are in line with product compliance management requirements and meanwhile help to explore new business development, to navigate innovation and help with the company's long-term healthy business development," she says.

The food industry has always been a highly regulated industry. Tang says that the challenges in business innovation and decision-making are mainly because of the increasing unpredictability and uncertainty of the legal and regulatory environment. "On one hand, our product innovation requires a longer delivery time in China; on the other hand, the rules and regulations change frequently, and the interpretations thereof are vague," she says. Faced with these challenges, Tang led her team to actively cooperate with industry associations and work with local and multinational enterprise partners to jointly develop industry action plans, and use industry intelligence and power to understand and influence the regulatory framework; Secondly, Tang and her team work closely with authoritative institutions on legislative programs to help them understand industry trends and collect global market data and regulatory references. In addition, they invited industry leaders to share their opinions on regulatory trends and explanations, and jointly advance the legislative agenda.

FUTURE OUTLOOK

Talking about the development plans for the next three to five years, Liu predicts that the competition will continue to intensify in the future. She and her team will focus on talent training and innovation, and strive for excellence in all aspects of legal work.

Guo says that due to impact of the economic downturn and this year’s pandemic, enterprises will likely change their ways of thinking and business strategies. The pressure will be transmitted to in-house counsel, posing higher requirements on their comprehensive competency and problem-solving ability. "Our legal team will continue to make progress, with the focus on product power, rate of return, competitive edge and brand power, and make efforts to realize value creation and performance improvement, and finally achieve the goal of industry empowerment," he shares.

The health and nutrition food industry has become more prosperous after the pandemic, and the entire industry expects more consumer demands and higher quality requirements, while the regulatory environment is becoming more stringent, Tang says. In this context, Danone's legal team will build a larger talent pool to enhance its ability to cope with future expansion and challenges. Meanwhile, they will make more efforts to integrate legal services into business solutions by exploring to find internal and external stakeholders and forecasting regulatory and industrial trends, to help the company find the best business solutions. " We are not just business partners; we are part of business," Tang stresses.

Li of WeBank cites a slogan as his vision, "banking everywhere, never at a bank." He explains: “in the next three to five years, banks will shift their way of service delivery from traditional branches or OTC services to online services, while the WeBank's goal is to be a smarter and more open bank, providing the mass with services tailored to their needs. ”

Li has a plan that covers three aspects. First, regarding the work mechanisms and systems, the legal team must align themselves with the company's philosophy and values, make continuous efforts to improve the legal and compliance management systems in line with the industry requirements and standards, and keep abreast of new laws and new rules and help the company with the implementation of those laws and rules. The team should also know company's business well, so that they could help the company with the legal and compliance management and risk assessment and control, and effectively protect the company's IPs and other legitimate rights and interests. They will also cultivate a compliance corporate culture to standardize employees' behaviors, to provide robust legal support for the implementation of the company's strategy and make contribution to the healthy and rapid development of various lines of business. Secondly, they will invest in the management tools, integrating cutting-edge technologies and advantages such as blockchain, AI and big data into the tools for the management of legal compliance, anti-money laundering, and related-party transactions. For example, using AI technology in legal review and compliance review to improve the accuracy and efficiency; using big data and AI learning technology to upgrade the anti-money laundering database, and improve the accuracy customer's identity verification and suspicious transactions identification. It is also important to build a trust relationship with judicial institutions based on blockchain technology, to optimize litigation procedures, shorten the time for dispute resolution, save judicial resources, and reduce the cost of post-loan disposal, and use big data and AI technology to build a smart system to accurately and effectively control related-party transactions. And finally, talent training is an ongoing effort. “We'll encourage our team member to learn new things and continuously help them improve their knowledge application ability, such as how to apply the civil law and other major laws in handling civil and commercial legal relations in the banking business. We want to help our team members to extend their reach – knowing the business while understanding laws – to find a balance between legal risk prevention and business innovation,” says Li.

联系我们

联系我们

关注公众号

关注公众号

联系我们

联系我们